will child tax credit monthly payments continue in 2022

It could also change whether the monthly installment payments continue in 2022. And not only that but 37million children have.

The Last Monthly Child Tax Credit Payments Go Out On Dec 15 The Washington Post

The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021.

. The future of the monthly child tax credit is not certain in 2022. Those payments are off the table for now but the credit isnt gone. But this may not preclude these payments.

This has prompted some states like Vermont to sign a new child tax credit into law. 15 Democratic leaders in Congress are working to extend the benefit into 2022. Washington lawmakers may still revisit expanding the child tax credit.

There May Still Be Hope for Monthly Child Tax Credit Payments in 2022. American finances are tight. The future of the monthly child tax credit is not certain in 2022.

Now even before those monthly child tax credit advances run out the final two payments come on Nov. However that is set to return to 2000 for 2022 as Congress has failed to extend it. The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress.

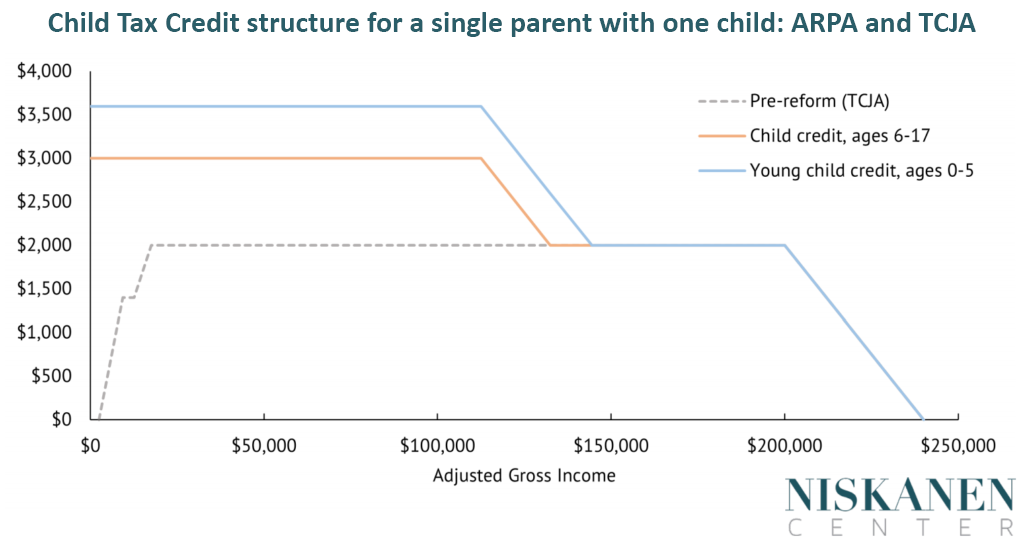

The way it looks right now the increased child tax credits wont be continuing into 2022. The benefit for the 2021 year. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022. This combination of circumstance has created a troubling scenario for many families. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic.

The american rescue plan made a few key changes to the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus for kids under. The enhanced child tax credit including advance monthly payments will continue through 2022 according to a framework democrats released thursday. As it stands right now child tax credit payments wont be renewed this year.

Regardless of what happens with the Child Tax Credit anyone who received the benefit in 2021 should make it known on their tax return. However many parents in the MoreChild Tax Credit. Therefore child tax credit payments will NOT continue in 2022.

Now even before those monthly child tax credit advances run out the final two payments come on Nov. 15 Democratic leaders in Congress are working to extend the benefit into 2022. President Joe Bidens near-2 trillion Build Back Better social spending bill wouldve lengthened this years expiring expansions to the tax break through 2022 by Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. 1 day agoInstead of getting advanced monthly payments and the larger amount from the enhanced benefit families can claim the original credit which is a maximum of 2000 when they file their 2022 tax. I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022.

During the second half of 2022 parents enjoyed monthly Child Tax Credit payments. Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child. However for 2022 the credit has reverted back to 2000 per child with no monthly payments.

MONTHLY child tax credit payments could be coming back as Congressional lawmakers have revealed a plan. No monthly CTC. Theres a plan to extend the credit but politics is getting in the way.

Making the credit fully refundable. Losing it could be dire for millions of children living at or below the poverty line. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire.

However Congress had to vote to extend the payments past 2021. In most cases receiving the Child Tax Credit will not adversely impact a tax filing. The benefit for the 2021 year.

A CNBC report revealed that nearly 50 of the families who received monthly payments through the enhanced Child Tax Credit could not afford enough food to feed their families a mere five months. Inflation is rising monthly child tax credit payments have ended and stimulus payments are on the back burner. Losing it could be dire for millions of children living at or below the poverty line.

Heres Why by Angelica Leicht Published on May 19 2022.

Child Tax Credit Coming By Mail For Some Who Got Bank Deposit In July

New 3 000 Child Tax Credit To Start Payments In July Irs Says

Where Do We Go From Here On Tax Credits People S Policy Project

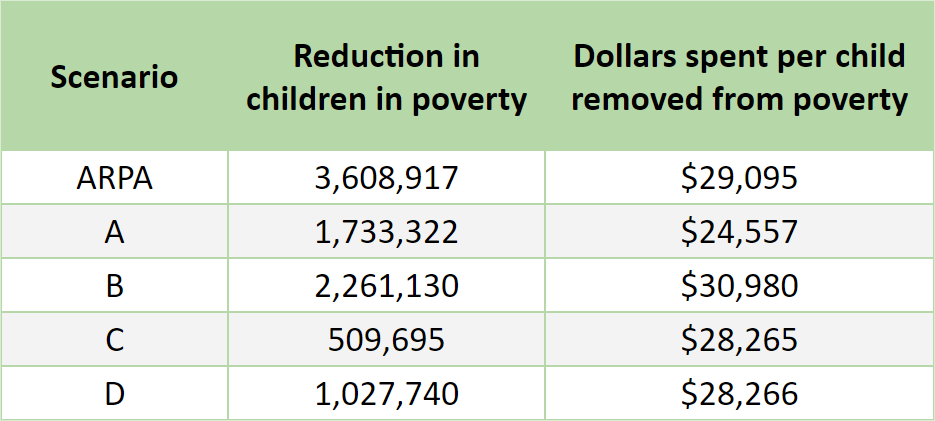

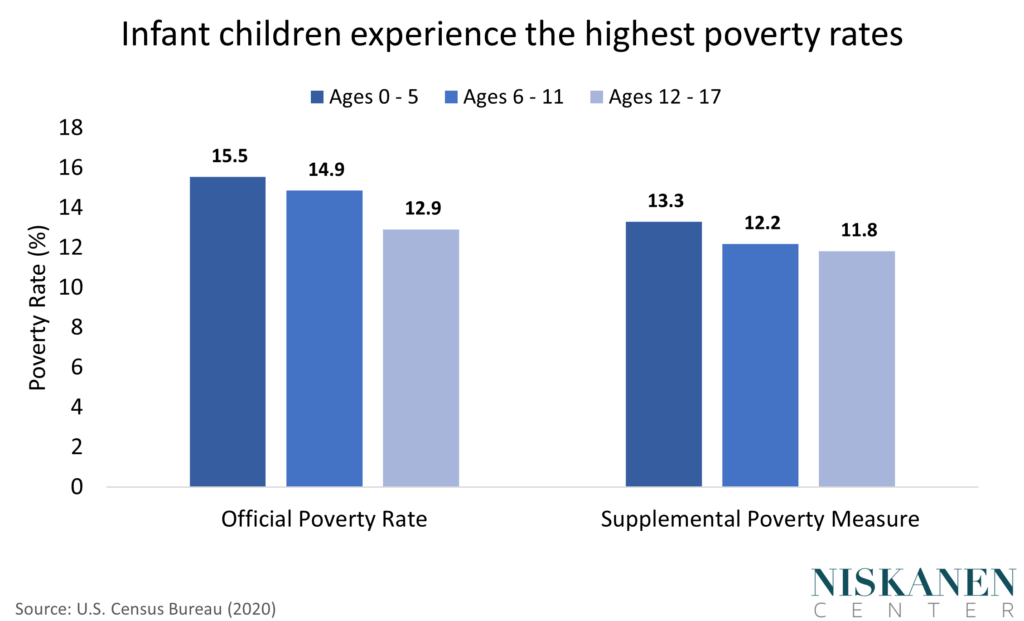

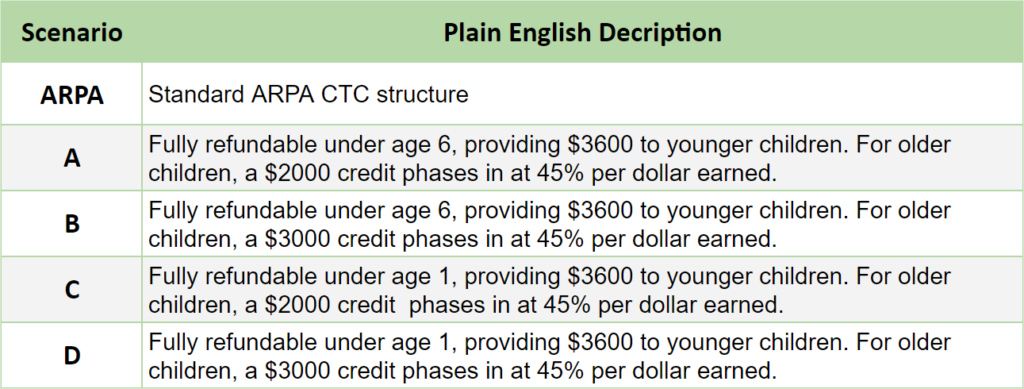

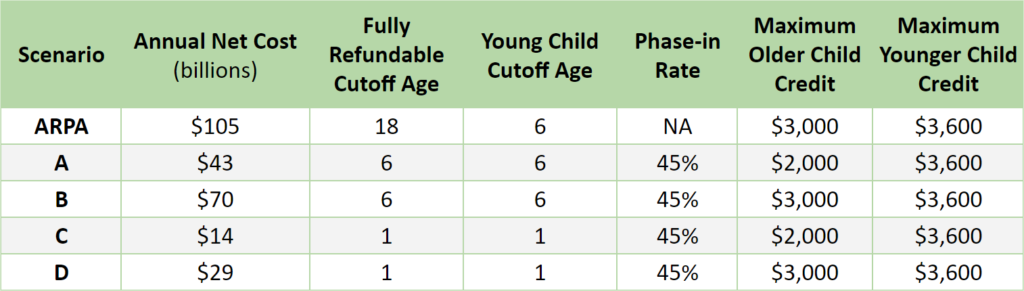

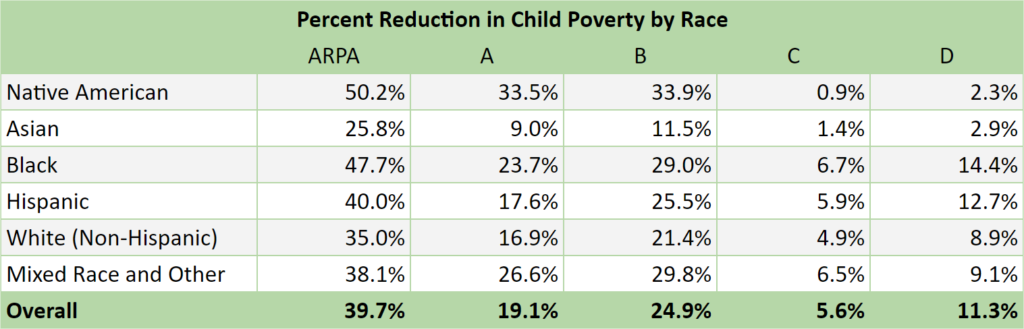

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

2021 Child Tax Credit Advance Payments Claim Advctc

The Advance Child Tax Credit Changes Coming

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Families Aren T Getting Child Tax Credit Checks For First Time In 6 Months

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

So There S No Fourth Stimulus Check But You Can Still Get A Child Tax Credit Wkrc

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

Families Aren T Getting Child Tax Credit Checks For First Time In 6 Months

The Advance Child Tax Credit Changes Coming

Receipt And Usage Of Child Tax Credit Payments Among Low Income Families What We Know

Will Monthly Child Tax Credit Payments Be Extended Into 2022

Bipartisan Reform Options For The Child Tax Credit Niskanen Center

What You Need To Know About The 2021 Child Tax Credit Changes America Saves